Out of Stock: This Founder Is Selling Spirituality and Everyone’s Buying

Lockdown essentials: groceries, toilet paper, hand sanitizer, and...crystals?

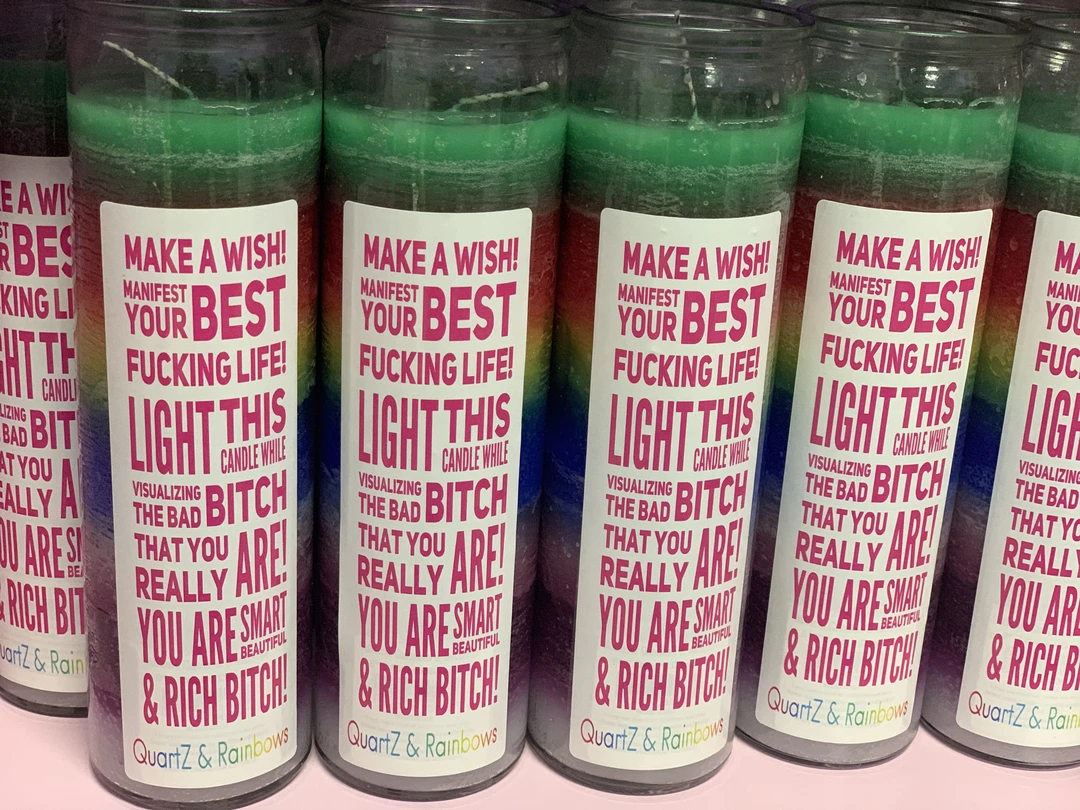

“I sell sage, Florida water, crystals—anything to lift you up and raise the vibe in your home or office,” says Zakia Torres, certified Reiki Master and founder of self-care and spirituality brand, Quartz & Rainbows.

Quarantine has been a time of solitude, forcing us to turn inward and take inventory of our lives. The process of reconnecting with oneself is key to self-care, and, for many, a path to spiritual discovery.

Zakia explains that in the absence of face-to-face time with others, people are seeking a sense of connectedness through spiritual rituals, like crystal healing and burning sage, known as “smudging”. These practices are meant to cleanse energies and set intentions—something that's particularly helpful as our days and spaces blur together.

“We all need something to believe in right now. And people need what I’m selling,” Zakia explains.

Her sales figures echo this sentiment: in April, Zakia’s self-care kit, “Quartz & Rainbows Good Vibes Bundle”, tripled in sales compared to the previous year.

Taking inventory

As a single mother and solopreneur, Zakia’s decision to ramp up operations to meet this surge in demand wasn’t a passive one. She had to be really honest with herself: Did she have the necessary time to invest her business? Did she have enough space in her home? Did she have the money available to buy inventory—and to restock quickly?

I have a five-year-old, a six-year-old, and a twelve-year-old at home during the day now. And Quartz & Rainbows—that’s my fourth baby.

When asked to describe an average day, I quickly understood why growing her business gave her pause. Between running a business and homeschooling and caring for three children, Zakia’s got her hands full.

“I work from home, by myself. I get up, I go to the post office to drop off the orders that I packed the day before. And then I do my runs: I buy my shipping materials, pick up supplies, whatever I need for upcoming orders. I’m running around all day. Then I come home to package orders and take care of my kids,” Zakia explains.

Strictly from a business perspective, she reassures me that the pandemic hasn’t considerably impacted her day-to-day. “Vendors are taking a bit longer than they used to, and they ship everything to my house now instead of me picking it up, which costs a bit more, but it’s actually saving me running-around-time. I get to spend that time with my kids,” explains Zakia.

And although she’s exhausted, Zakia says entrepreneurship is exhilarating and profoundly fulfilling, too. Her journey into this business started following heartbreak and a long period of depression—Quartz & Rainbows was the manifestation of her healing. And she wants to spread the love around: her mission is to inspire, heal, and empower women while educating them about the importance of self-care.

Seeing people rush to her website to order her products in a time of crisis wasn’t just a “cha-ching” moment for business, it was deeply personal. So she decided to go all in. It just came down to figuring out the right amount of inventory—and how she was going to afford it.

Separating church and state

“Even before the pandemic, inventory was the trickiest part. Partly because I don’t have enough space in my house, and sometimes I just don’t want to see boxes and supplies all over the place,” Zakia says.

But the biggest challenge—and one that’s shared by 92% of small business owners, according to a recent Shopify survey—is not having access to capital to purchase the inventory in the first place. Inventory is an expensive upfront cost, and in the early stages, businesses don’t always have the cash flow they need to stock up on a whim.

Zakia’s the first to admit that in the early days, she made some questionable financial decisions to keep her business afloat.

“I mismanaged my money and I’m not shy to talk about it,” Zakia says. She found herself using money she had allocated for her business on personal expenses, like rent and credit card bills. She's not alone: a common challenge many first-time entrepreneurs struggle with is figuring out how to balance their business and personal finances.

“It seemed like a good idea, you know? To take all the money I made and pay off of my personal bills. It seemed responsible. But it’s not. It messed up my entire flow. It took away from the money that I wanted to reinvest in my business so I was always playing catchup with the orders,” Zakia says.

This went both ways. Sometimes, in a pinch, she’d used personal money to buy business inventory—a finance faux-pas that leaves many business owners scrambling at tax time.

Technically, you can use the same account to fund personal and business expenses. And if you are absolutely meticulous about categorizing expenses as business or personal with every single receipt, this system could work for you. But most business owners aren’t meticulous about categorizing expenses, so this manual process often fails them—in a big way. At best, it gives business owners an imperfect picture of how their business is performing, but in many cases, it can bankrupt the business altogether.

“I'm still learning about how to handle money in general. I didn't have much growing up, so I didn’t know what to do with it,” Zakia explains. Though it's one of the most crucial aspects to running a successful business, effective money management is a skill many first-time entrepreneurs have to learn on the job.

All I knew was that I was terrified of the word ‘debt’. I kept telling myself ‘pay it off, pay it off, whatever you do, pay it off’, and that’s actually bad. There’s a right way to take on debt and a right way to pay off debt.

Getting capital, without the judgment

“So here we are in 2020 during a pandemic, I’m 35, I’ve never experienced anything like this and I’m new to entrepreneurship. Business is good but I’m struggling to keep up with orders, and I get an offer from Shopify Capital,” Zakia says. “I didn’t take it immediately. It felt good not to owe myself or anyone anything. I had to really think about it. But at the same time, orders for my Good Vibes Kit started blowing up. So I decided to accept the offer,” says Zakia.

The next day, the money was in my account. I immediately bought a ton of inventory; more inventory than I've ever bought in the past two years.

When asked if she had ever considered a traditional small business loan or inventory financing, her response was familiar: “I never considered going to the bank because my credit score isn’t where it needs to be.”

Business owners with lower credit scores have a tough time securing the financing they need from traditional lenders, and can be shut out of certain loan types entirely. To make matters worse, Black entrepreneurs are disproportionately hurt by the lack of access to capital: they’re almost three times as likely as white entrepreneurs to have profitability hurt by lack of access to capital.

Shopify doesn’t judge you. They don’t look at your credit score. It’s totally up to your sales. Basically, they give you what they think you need and can pay back in a reasonable timeframe.

With more money, she had more inventory at hand, so she could fulfill more orders. She could also double-down on the marketing to keep pace with the ever-growing demand for her products, which meant more income coming in.

And since repayment is automatic and integrated into her Shopify store, the better her store performs, the quicker she pays back her cash advance. “You’re only paying back based on your sales. If I have a slow day, they take a smaller cut,” Zakia explains.

After buying new inventory and paying off her cash advance, Zakia had tripled her business.

Sage advice

Zakia’s still learning the ins-and-outs of managing her finances, and how to juggle her growing business alongside her hectic home life, but she's optimistic about the future. “Because of Shopify Capital, I’ve been able to grow during the pandemic, I've been able to add new products, and I've been able to get orders shipped out as quickly as possible. Now I have bigger goals,” Zakia says.

It feels like I achieved something most people achieve in ten years, in only two years. And I feel like my happiness has been able to lift my customers up. I couldn’t ask for anything more.

Staying true to herself, and by extension, her brand, Zakia's advice to small business owners is completely unfiltered: “You have to mess up a few times before you learn. It’s part of the game.”

Illustration by Isabella Fassler