Look Past Revenue: 6 Ways to Increase Your Profit Margins

Your business is likely going through a few stressors right now, like tackling cash flow management, keeping customers happy, and finding ways to increase profit.

When it comes to improving profitability, managing and increasing profit margins are key to your company’s financial success. It’s an essential small business accounting strategy for those wanting to run a successful business both online and in-store.

The only problem? Profit margins are a challenging world. It’s easy to get lost trying to figure out profit margin ratios, operating profit margins, net versus growth, and more. It can be tricky to overcome the information overload and actually learn how to increase profit for your business.

In this guide, you’ll learn how to find the ideal profit margin formula for your business, plus create a profitability strategy that can keep you thriving and successful during uncertain times.

Table of Contents

What is gross margin?

Gross margin is the difference between a company’s revenue and cost of goods sold (COGS) divided by revenue. It’s shown as a percentage.

Gross margin helps a company figure out how much money it keeps after incurring the costs related to making the product it sells and/or the service it provides.

The formula for gross margin is:

(Total Revenue – Cost of Goods Sold) / Total Revenue

The higher your gross margin, the more money a company keeps on each dollar of sales. Higher margins can indicate whether your company is running a profitable operation and if sales are good.

What is a good profit margin?

If you’re asking yourself, “What is a good net profit margin?” then you’re on the right track. It’s safe to say that a good profit margin for your company depends on your location, industry, and personal circumstances.

For example, in 2019, industrial banks had the highest reported profit margin, with an average of 51.8%. While average profit margins in manufacturing hovered around 8.5%, according to the same research.

Retailers usually have a low profit margin compared to other sectors:

- Brick-and-mortar retailers tend to have profit margins between .5 and 4.5%.

- Web-based retailers generally have higher profit margins, while building supply and distribution retailers have the best margins—reaching as high as 6.5%.

The rise in shopping online has played a big role in keeping retail margins low. As a general rule of thumb, a 10% net profit margin is deemed average, while a 20% margin is deemed high and 5% low. If you want to compare your company’s performance based on profit and merchandise margins, check out the average profit margin for your industry.

What is a good gross profit margin?

A good gross profit margin for online retail is around 45.25%, according to NYU Stern School of Business. To reach a higher gross profit margin, you’ll need to develop a pricing strategy for your business.

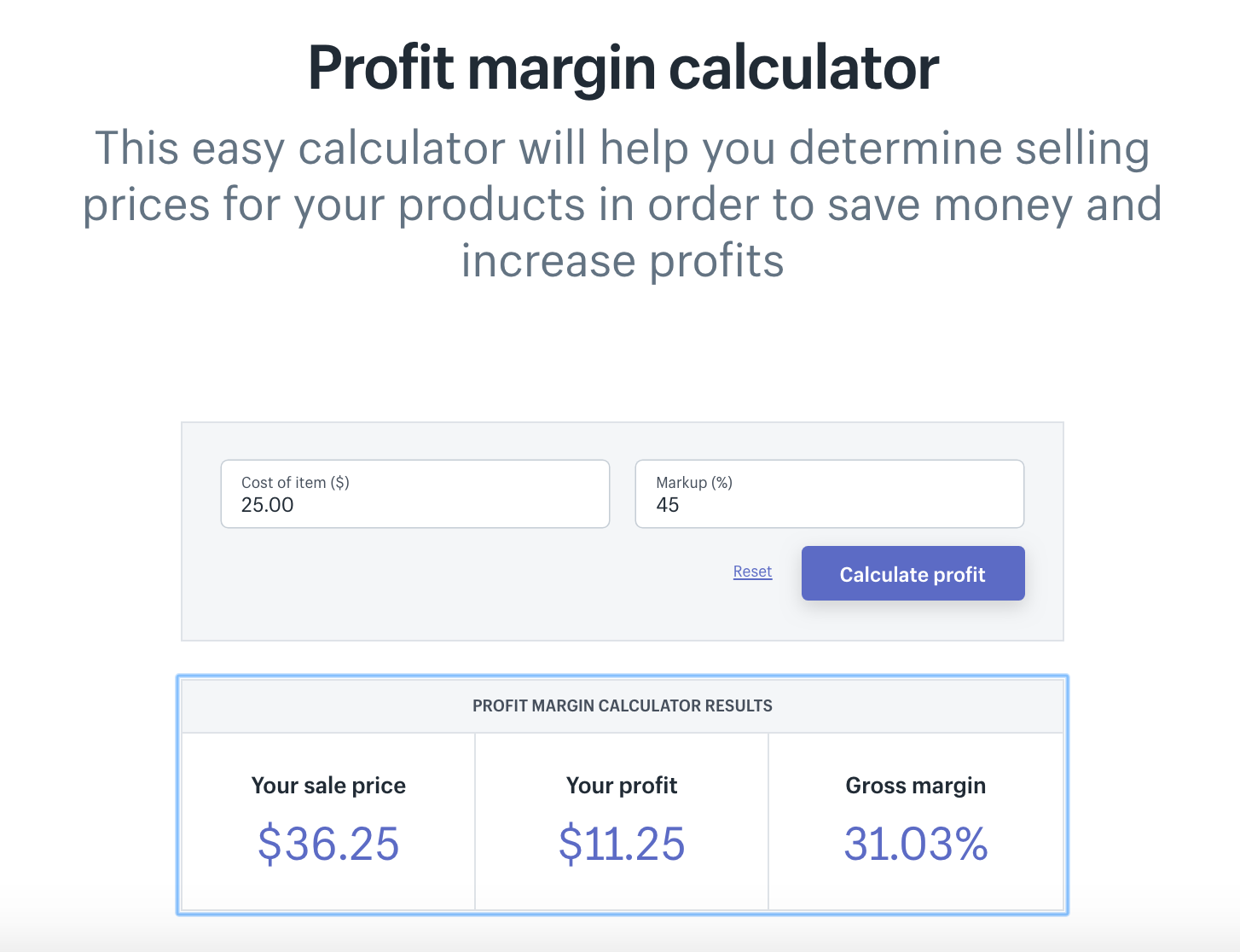

Shopify’s profit margin calculator can help you find a profitable selling price for your product. It’s easy-to-use and leverages a simple profit margin formula to calculate what price you should charge customers for your product for an optimal merchandise margin ratio.

Determining the best profit margin formula for a single product can help you figure out how to find net profit margin and improve profitability for your business.

How to increase profit margin

- Reduce operating costs

- Don’t obsess over per order profits

- Increase the trustworthiness of your store to generate sales

- Increase your average order value

- Create a customer loyalty program

- Raise your prices

1. Reduce operating costs

Reducing operating costs is a quick way to increase profit margin and improve profitability.

The tricky part to reducing operating costs is knowing what to cut, because these expenses—like utilities, payroll, and rent—vary from business to business.

Start by auditing everything that’s running your business, including:

- Labor costs

- Office space and utilities

- Employee benefits

- Equipment and maintenance fees

- Licenses and tax deposits

- Insurance

Then look at where you can cut back on expenses and how a premium software package can help. To choose the right technology for your business, ask yourself the following questions:

- What can I already do well? (For example, if you’re great at business financing, consider productivity or marketing software.)

- What do my employees spend too much time on each week?

- If I could take one time-consuming task off my mind, which one would it be?

For example, say you advertise a toll-free sales number on one of your sites, but it puts extra work on your plate without helping improve margins. Would you be willing to reduce your workload by 50% if it meant giving up only 15% of your business?

If yes, you could take that savings—both in terms of time and money—and put it into, say, better serving multiple customers at once with a chatbot or improving your site. Phone support may be a rarity among many online businesses, but a number of ecommerce merchants still feel it’s necessary.

💡Tip: Browse the Shopify App Store for a live chat or Chatbot app.

Try to measure the impact removing an operating cost, such as a phone number on your site, has on margin improvement and customer satisfaction. Small business owners should always look for new ways to reduce operating costs without jeopardizing the quality of their store or making operations more difficult.

2. Don’t obsess over per order profits

Many businesses are unwilling to lose money on an order, even if that means ending the relationship with an unhappy or dissatisfied customer. You may have had a similar experience, which often goes something like this:

“I’m sorry, sir. We only made $X on your purchase, so if we [fill in your reasonable request here], we’d lose money on your business. I hope you understand.”

This is a penny-wise approach and a bad way to do business in today’s highly social and connected world. If you’re not losing money on orders to quickly and proactively resolve customer problems, you’re missing out on the chance to improve profit margin.

Customers are so accustomed to mediocre service that when a business goes out of its way to proactively resolve a problem—without charging them—they’re blown away. Apart from the life-long value of that customer, you’ll receive referral marketing and recommendations that are impossible to purchase.

If you’re running an ecommerce store, here are four ways you can invest in the future of your business and, ultimately, your long-term bottom line:

- Did something inexpensive break? Ship customers a free replacement immediately without requiring them to hassle with the return.

- If an expensive item needs to be returned, ship them a replacement as soon as they submit tracking confirmation of the return instead of waiting until it hits your warehouse.

- If a long-time customer needs something ASAP, overnight it to them at no charge.

- If a customer wasn’t happy with a purchase, proactively issue a partial refund to help compensate him for the disappointment.

Serving customers like this will cost a bit more in the short term, but will pay incredible dividends as you build a loyal and highly vocal fan base that results in a very healthy bottom line.

3. Increase the trustworthiness of your store to generate sales

Trust is essential for generating sales and increasing profit margins. Shoppers today have endless options to choose from when looking for a product, most of which are tracked by marketers and store owners. But trust is harder to measure and truly understand.

At Shopify, we want to know what makes an online store trustworthy. In 2019, we ran a series of interviews with North American shoppers, having them review a recent purchase involving a store they were unfamiliar with or a product they’ve never bought before. We also asked them to make a purchase from a Shopify store they’ve never bought from before.

The goal was to find out what makes a new shopper comfortable with buying a new item or buying from a store they were unfamiliar with. There were two patterns that influenced shoppers’ decisions on whether or not to buy a product:

- Trust builders. Elements or design details that make first-time shoppers feel more relaxed and confident in their purchase.

- Trust breakers. Elements that make first-time shoppers question the quality of a business and create feelings of distrust that their purchase is a safe choice.

These findings also revealed five key ways your online store can build trust with new shoppers and sell more online:

- Create a welcoming homepage that makes a good first impression for new shoppers.

- Make product information easy to find with thorough product descriptions and precise search results.

- Share your brand story to help shoppers feel like you’re an authentic business.

- Show customer satisfaction by providing shoppers with social proof.

- Make transaction costs and pricing transparent.

Building trust between you and a first-time shopper encourages them to make a purchase in your online store and, in turn, increase profit margin.

4. Increase your average order value

If you want to increase profit margin, focus on increasing your average order value (AOV). Average order value is the average dollar amount a customer spends per transaction in your store.

You can calculate average order value by using a simple formula: total revenue / number of orders = average order value.

Shopify customers reports can calculate AOV for you, or you can use a number of helpful apps in the Shopify App Store.

There are a number of ways you can increase AOV in your ecommerce store:

- Add product recommendations to product and checkout pages. By adding popular products, or products that other shoppers purchased in addition to what’s currently in a person’s cart, you can not only increase average order value but also make a shift from low-margin sales to high-margin sales.

- Upsell or cross sell complementary products. Rather than suggesting popular items in your store, you can surface products that go well with items in a shopper’s cart. For example, coffee filters for a brewing station or shaving cream with razors.

- Provide order minimum incentives. You can also increase AOV and get higher margins by encouraging customers to spend a minimum amount. This could be a 15% discount on orders over $75 or a minimum order amount for free shipping, which is easy to set up in Shopify.

- Create product bundles or packages. To get shoppers to purchase more, create bundles of products that cost less when bought together versus individually. When you bundle products, you increase the perceived value of a customer’s purchase and can help create a better shopping experience overall.

- Run deals and specials. A great way to generate more revenue for your store is to offer coupons or a special on higher margin products. Since these products make a higher profit per unit sold, you can afford to temporarily lower the price through enticing promotions for shoppers to take advantage of.

One of the most effective ways to improve your profit margin ratio is to increase average order value. For more on how to increase profit using this tactic, look to 5 Highly Effective Ways to Increase the Average Order Value of Your Online Store

5. Create a customer loyalty program

Customer loyalty programs are a surefire way to increase profit margins and improve profitability in retail and the service industry. As many as 84% of consumers say they would keep on with a company that offers a loyalty program. With that, 66% of customers state earning rewards influence their buying behavior.

You can create a customer loyalty program to sell to existing customers rather than spend more money to acquire new ones.

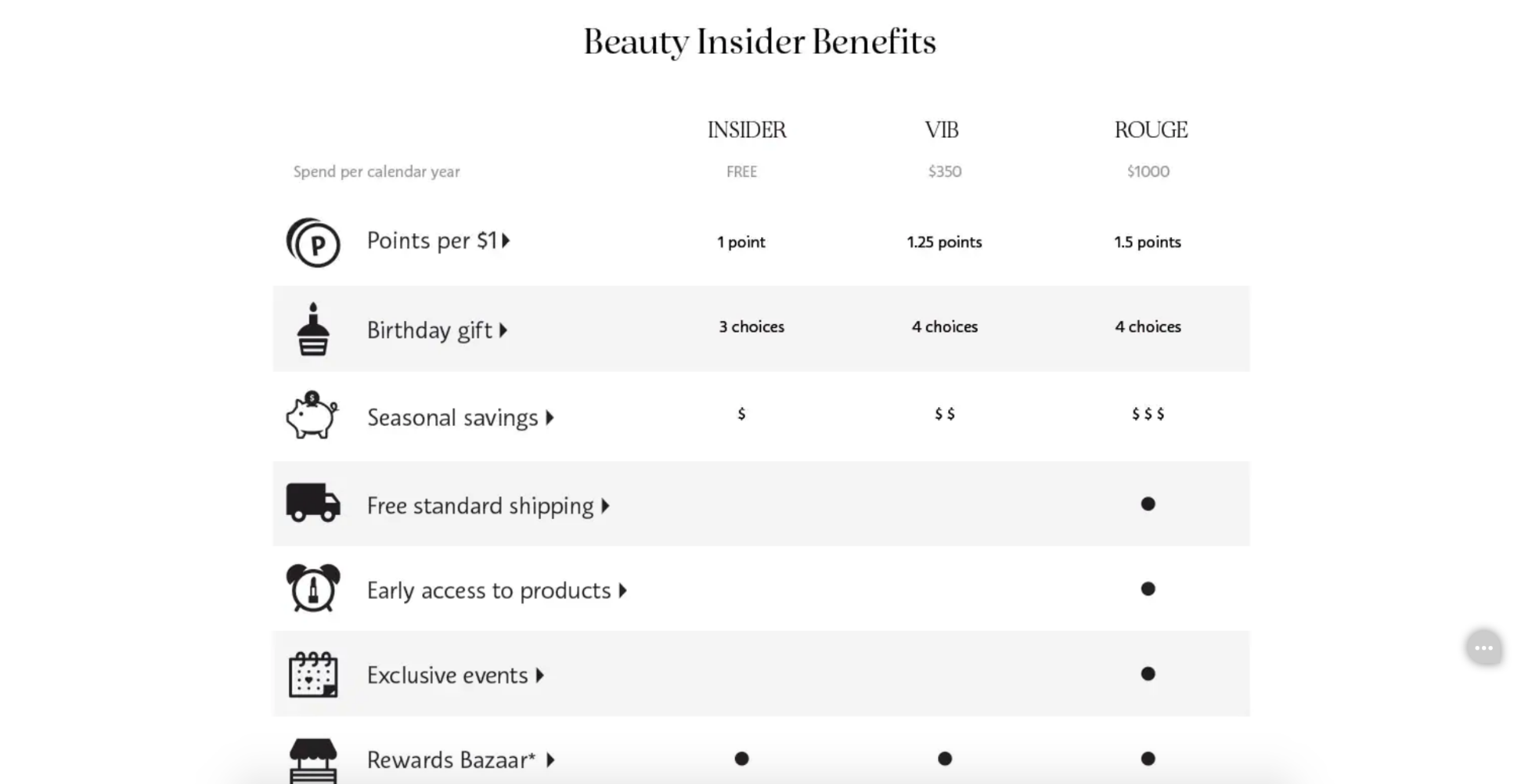

Sephora is known for having a strong customer loyalty program. The program has over 17 million members who make up nearly 80% of the company’s sales.

Members earn rewards for each purchase based on a point system. Once a member accrues enough points, they can choose how to use them—whether through gift cards or discounts to help offset the high prices without cheapening the product.

The best loyalty programs focus on the customer. They provide real value that shows loyal customers you appreciate their business and want to do what’s best for them. While heavy discounts aren’t reasonable from a small business finance standpoint, you can still find reasonable ways to reward customers so they buy more frequently and make a shift from low-margin sales to high-margin sales.

6. Raise your prices

Raising prices is an intimidating idea when it comes to a retailer’s profit margin. If they raise prices, they assume customers will abandon them, sales will dry up, and the business will collapse into the dust heap of failure. If you’re reselling an existing product in your ecommerce store, a small increase in price can do miracles for your bottom line, especially if there’s market demand.

Imagine the following scenario for a popular item in your online store:

- Item retail cost: $100

- Wholesale cost: $80

- Profit: $20

- Profit margin: 25% ($20 profit / $80 cost)

Now image that, after being inspired by an article on the Shopify blog, you re-priced this item at $110:

- Item retail cost: $110

- Wholesale cost: $80

- Profit: $30

- Profit margin: 37.5% ($30 profit / $80 cost)

Our minor 10% increase in prices resulted in a massive 50% increase in profits and gross margin!

If you’re not sure where to start on raising prices, consider the following information from Statista on the average order value of US online shopping orders in the second quarter of 2019, differentiated by the type of device.

During the quarter, online orders placed from desktop had an average value of $135.07, while orders placed from tablet and mobile device had an average value of $101.95 and $94.85, respectively.

Under the best-case circumstances—assuming you have a strong unique selling proposition and aren’t competing on price—your conversion rates won’t dive and you’ll have achieved an instant 50% increase in your overall profits. Even with a significant 30% drop in conversions, you’d still be making more money than under your old pricing model, but with fewer customer servicing costs to consider.

When implementing this strategy, keep the following in mind: make sure you test different pricing levels. While raising prices is often very effective, you’ll need to confirm it for your market/business.

If you have a large catalog, testing pricing on thousands of products can be a tall task. Start out by performing an ABC analysis to find best-selling products in your inventory, then test their pricing.

This strategy relies on having a unique selling proposition and offering value to your customers. The more price-sensitive your customers, the less effective this will be. If you don't have a unique selling proposition, you need to get one.

Finding the ideal profit margin for your business

There’s no doubt improving profit margins is a valuable strategy for small businesses. As you go about improving profitability for your business, be sure to check out these tips on how to perform a break-even analysis. You’re bound to quickly figure out if a new product or service will be profitable and can make smarter business decisions for the future.

With these tips on increasing retailers’ profit margins in mind, you can create a strong foundation for your business and weather any economic uncertainty for the long run.

Profit margin FAQ

How do you calculate profit margin?

To find profit margin, divide your gross profit by revenue. To make the margin a percentage, multiply your result by 100. If the margin is 30%, that means you keep 30% of your total revenue.

What does the profit margin tell you?

Since profit margin is the ratio of your company’s profit (sales minus expenses) divided by revenue, it tells you how your company is handling finances and how efficient your operation is.

Is a high profit margin good?

Yes, a high profit margin is good, because it indicates that your company can make a reasonable profit on sales. Compared to the industry average, a lower margin can mean your company is underpricing. Investors typically pay more for a business with higher gross profit.

What is gross profit percentage?

Gross profit percentage, also known as gross margin, is the percentage margin you earn on a product or service after deducting production costs from the revenue. Costs can include labor, materials, overhead, and more.

What is a good profit margin for retail?

A good online retailer’s profit margin is around 45%, while other industries, such as general retail and automotive, hover between 20% and 25%.

What does operating profit margin mean?

Operating profit margin shows how much profit a business makes after paying for the costs of production including wages, materials, and other operating expenses. It’s expressed as a percentage and indicates how efficiently a company controls the cost and expenses associated with operations.

How do I calculate operating profit margin?

To calculate operating profit margin, subtract your total operating expenses from your gross profit to calculate operating profit. Divide your operating profit by gross revenue to calculate your operating profit margin.