Drinking in the Haus: How Funding Helped This Booze Brand Grow 500% During the Pandemic

In lockdown, boundaries don’t exist: time is measured in big and small weekends, pajamas double as work clothes, and the home is the office, gym, and bar. So, cocktail hour can be any hour, really.

In lockdown, boundaries don’t exist: time is measured in big and small weekends, pajamas double as work clothes, and the home is the office, gym, and bar. So, cocktail hour can be any hour, really.

And the data proves that the home bar is getting a lot of action. One Nielsen study found that online alcohol sales were up 378 percent the week of April 11 over the same week last year, with spirits and pre-mixed cocktails leading the way.

Which is great news for farm-to-bottle apéritif brand, Haus.

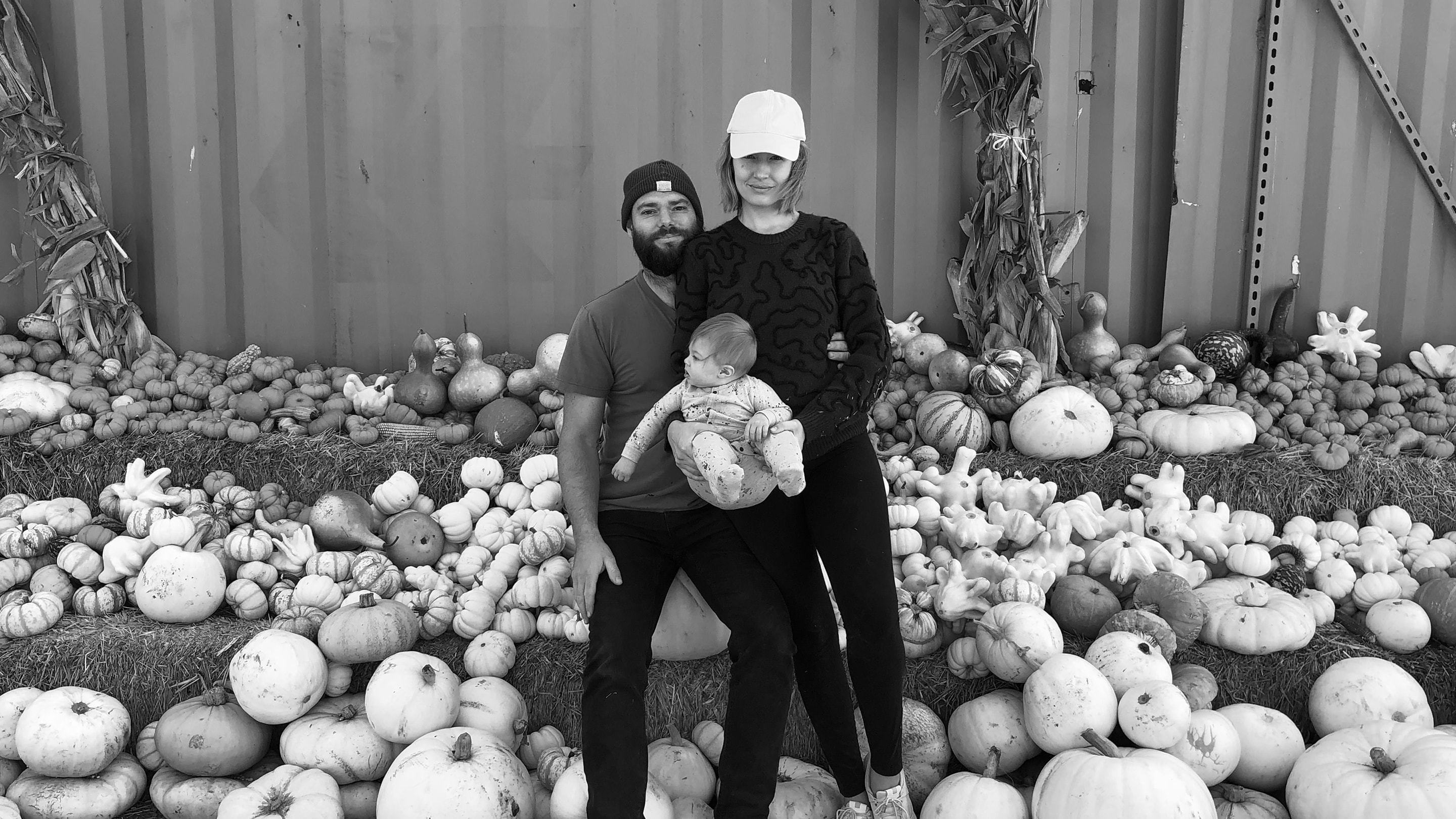

The husband-and-wife duo, Helena Price Hambrecht and Woody Hambrecht, founded Haus in their living room with a bucket of chardonnay, along with lemons and elderflower from their yard.

Tired of spirits with too much alcohol, mystery ingredients, and the hangovers that accompany them, they wanted to produce something with natural, whole ingredients, that could be sipped on easily throughout the night.

“Everything that you find on the shelves is owned by a corporation, with decisions made out of a corner office somewhere. Products are too sugary. The branding is corny. These big brands don’t resonate with our generation,” Helena explains.

They also wanted to change the drinking culture in America—moderation in binge drinking’s stead. There’s a growing movement towards healthier living and conscious consumption, especially among those under the age of 40. And these drinkers aren't having their needs met by corporate alcohol brands.

Serving stiff competition for big alcohol

Despite consumer trends, distribution is still gate-kept by a handful of companies: Diageo, Pernod, Sazerac, Beam-Suntory, and Campari Group. Historically, the only way to scale as a spirit brand was to get acquired by one of these companies, Helena explains.

That didn’t jive with the couple. They didn’t see their brand being sold in liquor stores and didn’t want to be reduced to a niche ingredient used in cocktail bars, either.

When we moved to Sonoma, I saw how hostile the big corporations were towards independent brands. How no one could succeed unless they were owned by them. And I just couldn’t help myself. It seemed like a problem worth solving.

They wanted to sell directly to their consumers and ink wholesale deals to target their buyers in their natural habitats: coworking spaces, social clubs, and restaurants. This direct-to-consumer distribution strategy was key to the brand’s mission to subvert the American drinking culture and the big corporations that encourage it.

Woody, a third-generation winemaker, discovered that Haus products could be sold direct-to-consumer in most states under the same exceptions that wine producers rely on. In other words, if it was made mostly of grapes, it could be sold like wine.

Since keeping alcohol levels lower than the 40% alcohol by volume (ABV) typical of traditional spirits was their intention from the outset, creating a beverage from wine made perfect sense.

Conveniently, a 200-acre farm in Sonoma, California is where the couple calls home, so they had little trouble sourcing the unoaked chardonnay that they use as their base ingredient today.

Since the brand was largely built on the idea of gathering, with Haus products as the nectar that brought people together and ideas to fruition, community-focused initiatives quickly became important to the brand.

With this in mind, they launched their Haus membership program. Similar to a wine club, members across the United States can sign up for a monthly shipment of spirits, ranging from one bottle to six. But unlike most traditional wine clubs, the Haus membership doesn't cost anything. (Of course, you don't need a membership; you can purchase individual bottles, too.)

We’re building the first direct-to-consumer company in the liquor space, ever.

Haus retains its community through trendy members-only events and restaurant partnerships, and is extremely intentional about curating a social experience that people want to partake in and share with their network. Which was working well—until COVID-19 hit.

Quarantinis, anyone?

The pandemic swept events and in-person experiences off the table, leaving the team in a scramble. Could a communal brand survive now that many social rituals were outright prohibited?

Venture capitalists in California were warning that business owners needed 24 months of runway to survive, a buffer that simply isn't available to most early-stage businesses.

Luckily for Woody and Helena, the pandemic forced another shift in consumer behavior that worked to their advantage: suddenly, everyone was buying alcohol online. This reinforced their core ecommerce model, and without hesitation, they jumped on the opportunity to ramp up their online sales.

They just needed some cash to go all in—and they needed it fast.

Despite their increasing popularity, Haus hadn't yet become profitable. They were investing all of their revenue into scaling their business, so every penny they earned went back into their farm, their product development, and their employees.

The financial exercise of assessing our cash flow was so important. We wanted to make our business as nimble as possible without firing anybody. And what we realized was that we could keep growing if we shifted our business online.

“We knew that we were going to need more capital. We had planned to raise another round from our original investors so that we could grow even faster, so we figured, now’s a good time as any,” says Helena.

Securing "founder-friendly" capital

Since the founders needed money fast while maintaining total control over their brand, venture funding was out of the question. And with typical lenders, like banks, the process of receiving a small business loan can take up to three months. Some lenders may offer funding in as little as 30 days, but the paperwork and the vetting process is gruelling for business owners who are already spread thin.

“We weren’t old enough as a business to be approved for a bank loan, and all the other types of debt financing that we explored were just terrifying,” Helena explains.

We wanted a founder-friendly way of taking capital that wasn’t through a bank or through venture funding. That’s when we found out about Shopify Capital.

Shopify Capital offered them an alternative. Capital gives qualifying merchants access to funding to grow their business. There’s no lengthy application process, credit checks, or extensive paperwork required.

There was no heavy-lifting with Shopify. They have access to all of our business data and all of our transactions run through Shopify’s platform. They made an educated decision quickly about how much money we qualified for and we received the funds in our bank account a few days later.

Shopify Capital is most frequently used to either fuel growing businesses or to help business owners better manage their cash flow. The Haus team put their Capital offer to use by doubling down on their digital marketing investment.

The pivot has paid for itself, and then some. Their return on ad spend was up 250% as of April, and their overall business has grown 500% since January.

“I feel like we haven’t even begun to tap into the ecosystem of what Shopify can do for us. And that’s exciting,” Helena says.

Small businesses have real options to grow with Shopify Capital. The way they want to grow, in a way that’s aligned with their brand. That was really important to us.

Funding your future

Many business owners wrestle with the idea of raising money, viewing funding as little more than bad debt. But the old adage “it takes money to make money” rings true for the Hambrechts. Indeed, raising money is a key part of being a business owner. Helena, a startup veteran, says she’s got no problem seeking funding because she believes in her product and the company’s ethos—she’s betting on herself.

Looking forward, the Haus founders hope to continue using Shopify Capital to fuel their business, and see it as a sustainable growth lever for the brand. “It’s great to know that we can continue to take funding from Shopify Capital. It's not just a one-time thing if we're performing well,” says Helena.

As for her advice to other small businesses navigating the pandemic, Helena says: “Assume that whatever plans you have laid out in front of you can be overturned overnight. Everyday is going to be different. You have to be adaptable and you have to stay calm."

Illustration by Isabella Fassler