Break-Even Analysis: How to Predict If Your Next Venture Will Be Profitable

Starting a business often carries risk. As the saying goes, "You have to spend money to make money."While that's not always true, there is one very effective way to lower your risk: do a break-even analysis. A break-even analysis will tell you exactly what you need to do in order to break even and make back your initial investment.

If you run a business—or you’re thinking about starting one—you should know how to do a break-even analysis. It’s a crucial activity for making important business decisions.

What is break-even analysis?

A break-even analysis is a useful tool for determining at what point your company, or a new product or service, will be profitable. Put another way, it’s a financial calculation used to determine the number of products or services you need to sell to at least cover your costs. When you’ve broken even, you are neither losing money nor making money, but all your costs have been covered.

Learn More: How to Conduct a SWOT Analysis for Your Business

For example, a break-even analysis could help you determine how many cell phone cases you need to sell to cover your warehousing costs. Or how many hours of service you need to sell to pay for your office space. Anything you sell beyond your break-even point will add profit.

There are a few definitions you need to know in order to understand break-even analysis.

- Fixed Costs: Expenses that stay the same no matter how much you sell.

- Variable Costs: Expenses that fluctuate up and down with sales.

Why you must do a break-even analysis

There are many benefits to doing a break-even analysis.

Price smarter

Finding your break-even point will help you price your products better. A lot of psychology goes into effective pricing, but knowing how it will affect your profitability is just as important. You need to make sure you can pay all your bills.

Cover fixed costs

When most people think about pricing, they think about how much their product costs to create. Those are considered variable costs. You still need to cover your fixed costs like insurance or web development fees. Doing a break-even analysis helps you do that.

Catch missing expenses

It’s easy to forget about expenses when you’re thinking through a small business idea. When you do a break-even analysis you have to lay out all your financial commitments to figure out your break-even point. This will limit the number of surprises down the road.

Set revenue targets

After completing a break-even analysis, you know exactly how much you need to sell to be profitable. This will help you set more concrete sales goals for you and your team. When you have a clear number in mind, it will be much easier to follow through.

Make smarter decisions

Entrepreneurs often make business decisions based on emotion. If they feel good about a new venture, they go for it. How you feel is important, but it’s not enough. Successful entrepreneurs make their decisions based on facts. It will be a lot easier to decide when you’ve put in the work and have useful data in front of you.

Limit financial strain

Doing a break-even analysis helps mitigate risk by showing you when to avoid a business idea. It will help you avoid failures and limit the financial toll that bad decisions can have on your business. Instead, you can be realistic about the potential outcomes.

Fund your business

A break-even analysis is a key component of any business plan . It’s usually a requirement if you want to take on investors or other debt to fund your business. You have to prove your plan is viable. More than that, if the analysis looks good, you will be more comfortable taking on the burden of financing.

When to use a break-even analysis

There are four common scenarios when it helps to do a break-even analysis.

1. Starting a new business

If you’re thinking about starting a new business, a break-even analysis is a must. Not only will it help you decide if your business idea is viable, but it will force you to do research and be realistic about costs, as well as think through your pricing strategy.

2. Creating a new product

If you already have a business, you should still do a break-even analysis before committing to a new product—especially if that product is going to add significant expense. Even if your fixed costs, like an office lease, stay the same, you’ll need to work out the variable costs related to your new product and set prices before you start selling.

3. Adding a new sales channel

Any time you add a new sales channel, your costs will change—even if your prices don’t. For example, if you’ve been selling online and you’re thinking about doing a pop-up shop , you’ll want to make sure you at least break even. Otherwise, the financial strain could put the rest of your business at risk.

This applies equally to adding new online sales channels, like shoppable posts on Instagram. Will you be planning any additional costs to promote the channel, like Instagram ads? Those costs need to be part of your break-even analysis.

4. Changing the business model

If you’re thinking about changing your business model, for example, switching from dropshipping products to carrying inventory, you should do a break-even analysis. Your costs could change significantly and this will help you figure out if your prices need to change too.

Break-even analysis formula

Before we start calculating break-even points, let’s break down how the formula works.

Your break-even point is equal to your fixed costs, divided by your average price, minus variable costs.

Break-Even Point = Fixed Costs/(Average Price — Variable Costs)

Basically, you need to figure out what your net profit per unit sold is and divide your fixed costs by that number. This will tell you how many units you need to sell before you start earning a profit.

As you now know, your product sales need to pay for more than just the costs of producing them. The remaining profit is known as the contribution margin because it contributes cash to the fixed costs.

Now that you know what it is, how it works, and why it matters, let’s break down how to calculate your break-even point.

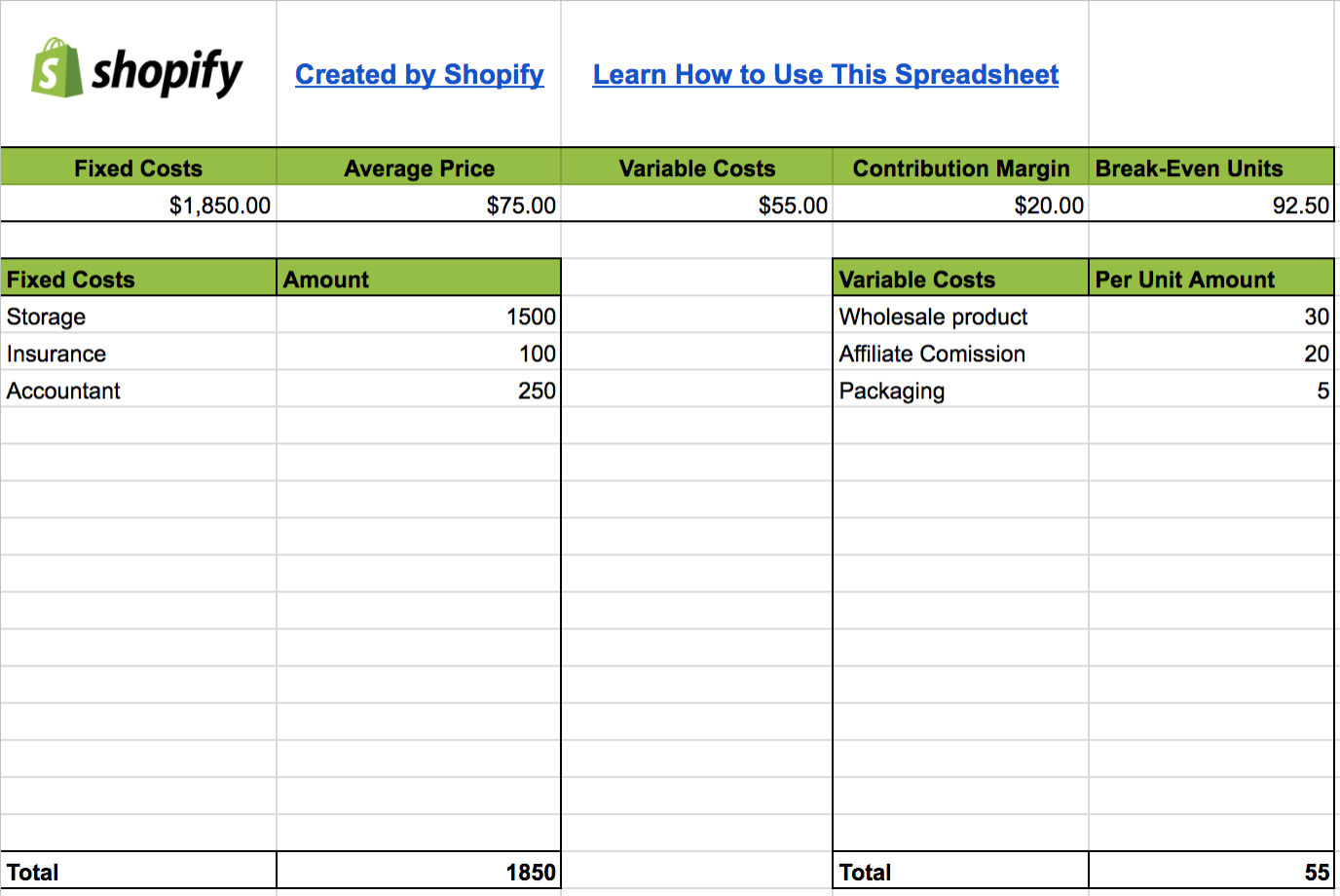

Before we get started, get your free copy of the break-even analysis template here . After you make a copy, you’ll be able to edit the template and do your own calculations.

Step 1 - Gather your data

The first step is to list all the costs of doing business. Everything from the cost of your product, to rent, to bank fees. Think through everything you have to pay for and write it down.

The next step is to divide them into fixed costs, and variable costs.

1. Fixed costs

Fixed costs are any costs that stay the same, regardless of how much product you sell. This could include things like rent, software subscriptions, insurance, and labour.

Make a list of everything you have to pay for no matter what. In most cases, you can list the expenses as monthly amounts unless you’re considering an event with a shorter time frame, such as a three-day festival. Add everything up. If you’re using the break-even analysis spreadsheet, it will do the math for you automatically.

2. Variable costs

Variable costs are costs that fluctuate based on the amount of product you sell. This could include things like materials, commissions, payment processing, and also labour.

Some costs could go in either category, depending on your business. If you have salaried staff, they will go under fixed costs. But if you pay part-time hourly employees who only work when it’s busy, they will be considered variable costs.

Make a list of all your costs that fluctuate depending on how much you sell. List the price per unit sold and add up all the costs, or use the spreadsheet which will add them up automatically.

3. Average price

Finally, decide on a price. Don’t worry if you’re not ready to commit to a final price yet, you can change this later. Keep in mind, this is the average price. If you offer some customers bulk discounts, it will lower the average price.

Step 2 - Plug in your data

Now it’s time to plug in your data. The spreadsheet will pull your fixed cost total and variable cost total up into the break-even calculation. All you need to is to fill in is your average price in the appropriate cell. After that, the math will happen automatically. The number that gets calculated in the top right cell under break-even units is the number of units you need to sell to break even.

In the break-even analysis example above, the break-even point is 92.5 units.

Step 3 - Make adjustments

Feel free to experiment with different numbers. See what happens if you lower your fixed or variable costs, or try changing the price. You may not get it right the first time, so make adjustments as you go.

Warning: Don’t forget any expenses

The most common pitfall of break-even analysis is forgetting things—especially variable costs. Break-even analyses are an important step towards making important business decisions. That’s why you need to make sure your data is as accurate as possible.

To make sure you don’t miss any costs, think through your entire operations from start to finish. If you think through your ecommerce packaging experience, you might remember that you need to order branded tissue paper, and that one order lasts you 200 shipments. If you’re thinking through your festival setup, you might remember that you’ll need to provide napkins along with the food you’re selling. These are variable costs that need to be included.

Limitations of break-even analysis

Break-even analysis plays an important role in making business decisions, but it’s limited in the type of information it can provide.

Not a predictor of demand

It’s important to note that a break-even analysis is not a predictor of demand. It won’t tell you what your sales are going to be, or how many people will want what you’re selling. It will only tell you how many units you need to sell in order to break even. It’s also important to note that demand isn’t stable. As you change your price, the number of people willing to buy your product will change as well.

Dependent on reliable data

Sometimes costs fall into both fixed and variable categories. This can make calculations complicated and you’ll likely need to wedge them into one or the other. For example, you may have a baseline labour cost no matter what, as well as an additional labour cost top that could fluctuate based on how much product you sell.

The accuracy of your break-even point depends on accurate data. If you don’t feed good data into the formula, you won’t get a reliable result.

Simplistic

The break-even point formula is simplistic. Many businesses have multiple products with multiple prices. It won’t be able to pick up that nuance. You’ll likely need to work with one product at a time or estimate an average price based on all the products you might sell. If this is the case, it’s best to run a few different scenarios to be better prepared.

As prices fluctuate, so do costs. This model assumes that only one thing changes at a time. Instead, if you lower your price and sell more, your variable costs might decrease because you have more buying power or are able to work more efficiently. Ultimately it’s only an estimate.

Ignores time

The break-even analysis ignores fluctuations over time. The time frame will be dependent on the period you use to calculate fixed costs (monthly is most common). Although you’ll see how many units you need to sell over the course of the month, you won’t see how things change if your sales fluctuate week to week, or seasonally over the course of a year. For this, you’ll need to rely on good cash flow management, and possibly a solid sales forecast .

It also doesn’t take the future into account. Break-even analysis only looks at here and now. If your raw materials cost doubles next year, your break-even point will be a lot of higher unless you raise your prices. If you raise your prices, you could lose customers. This delicate balance is always in flux.

Ignores competitors

As a new entrant to the market, you’re going to affect competitors and vice versa. They could change their prices, which could affect demand for your product, causing you to change your prices too. If they grow quickly and a raw material you both use becomes more scarce, the cost could go up.

Ultimately, break-even analysis will give you a very solid understanding of the baseline conditions for being successful. It is a must. But it’s not the only research you need to do before you starting or making changes to a business.

Strategies to lower your break-even point

What if you complete your break-even analysis and find out that the number of units you need to sell is too high? If the number seems unrealistic or unattainable, don’t panic. You may be able to make some adjustments to lower your break-even point.

1. Lower fixed costs

See if there’s an opportunity to lower your fixed costs. The lower you can get them, the fewer units you’ll need to sell in order to break-even. For example, if you’re thinking about opening a retail store and numbers aren’t working out, consider selling online instead. How does that affect your fixed costs?

2. Raise your prices

If you raise your prices, you won’t need to sell as many units to break even. The marginal contribution per unit sold will be higher. When thinking about raising your prices, be mindful of what the market is willing to pay, and expectations that come with a price. You won’t need to sell as many units, but you’ll still need to sell enough—and if you charge more, buyers may expect a better product or better customer service.

3. Lower variable costs

Lowering your variable costs is often the most difficult option, especially if you’re just going into business. But the more you scale, the easier it will be to reduce variable costs. It’s worth trying to lower your costs by negotiating with your suppliers, changing suppliers, or changing your process. For example, maybe you’ll find that packing peanuts are cheaper than bubble wrap for shipping fragile products.

Free break-even analysis template

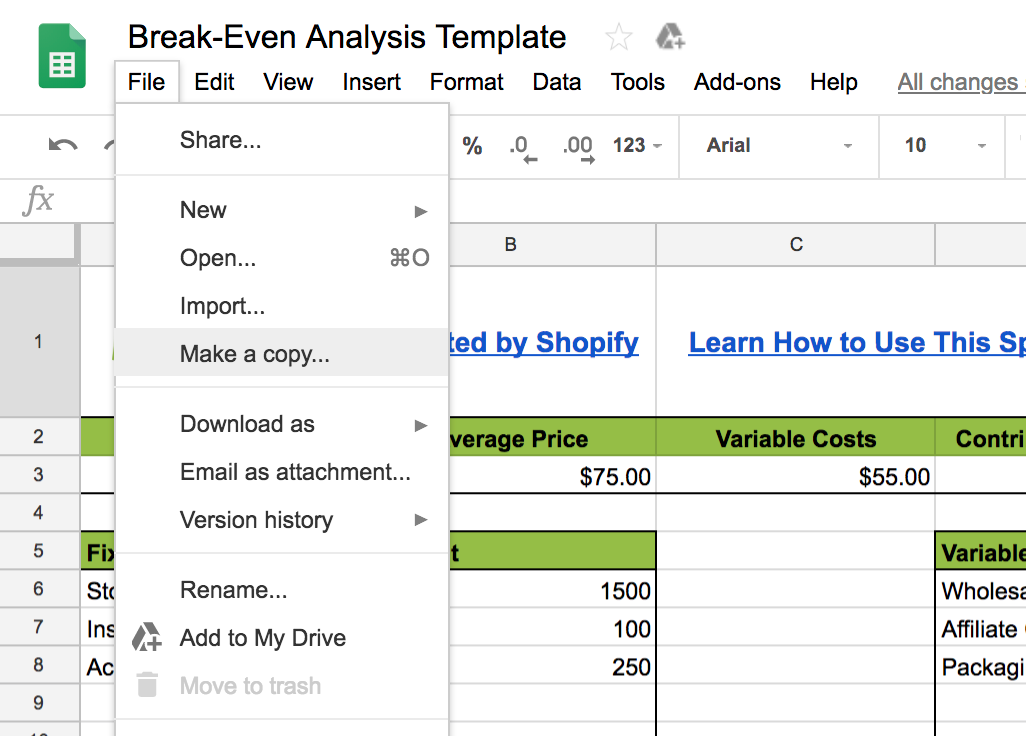

Don’t forget to grab your free break-even analysis template. Click here to access the template in Google Drive. To save your own editable version of the spreadsheet, click “File” → “Make a copy…”. You’ll need to be logged into your Google account to do this.

Doing a break-even analysis is essential for making smart business decisions. The next time you’re thinking about starting a new business, or making changes to your existing business, do a break-even analysis so you’ll be better prepared.